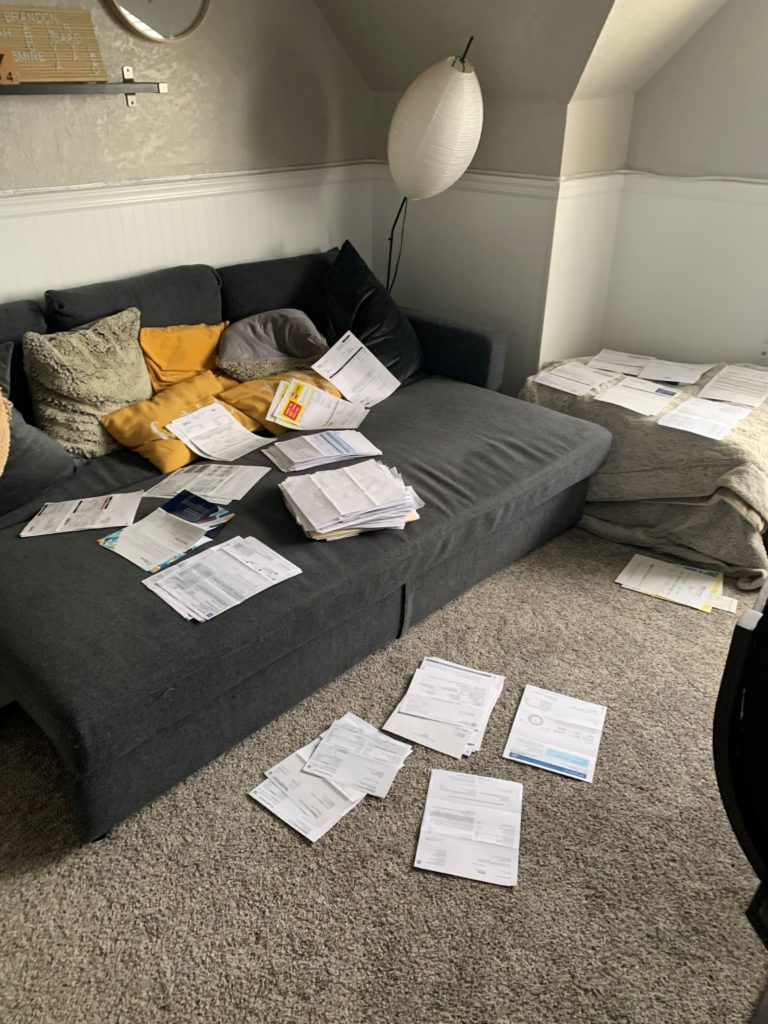

it is not just the holidays, but the following months has it’s own dread. Because I am a little lazy, all of our bill statements tend to pile up over the year. However, it is this time of year that I choose to file, organize and shred. I do this because it is the beginning of preparation for tax season.

I am certainly not making excuses, I should do it more than once a year. One of the biggest reasons is that filing is inconvenient. Statements, receipts, etc. go into a drawer after they are dealt with. When the drawer is filled, the stack goes upstairs to a pile. That pile grows unchecked until this time of year.

When I sort, I group everything by debtor. Things that are one and done like invoices go directly to the shred pile if significant time has passed and there is no warranty. Each individual stack is organized oldest to newest so that it can be placed into the file and automatically be in order year over year.

Trust me, my recent tax filings have been no picnic. Owing over $10,000 a few years ago was not only a shock but also caused me to evaluate what and how I am doing things. Getting audited was trying for my spare time and my relationship. One of the things that I changed as a result of this was my use of a tax professional. I used to do all of my own returns but that caused so much strife between my marriage that I have finally resigned to pay someone.

Maybe you have never done your own taxes. Or maybe you have never paid for them to be done. Well, there is a dirty little secret if pay someone to do it and that is the majority of the work is gathering and organizing the data to prepare the tax returns. The truth is, preparers just plug in the data as provided. Their fee is for their time and the small amount of liability that they incur by doing so.

Now, my taxes aren’t exactly straight forward but they are not the most complicated. Over the years I have had rents and royalties, LLC and investment complications. So, I have to do things like gather all of my utility bills and sum them for the year so that I can calculate the percentage of the cost that the rental has on the overall bill for deduction purposes.

The simple truth is I have to do this work whether I do the taxes or I have someone else do them. It so happens that I am forced to get organized way earlier when I hand it off whereas I may drag my feet when I am doing it myself. As my filing goes, any bill that is not used in taxes gets evaluated as to how much folder space I have. It really serves no purpose to have five years of bills filed. But when the folder starts getting full, I start culling years past. Those papers all go to the shredding box.

Speaking of shredding, I also eliminate my eighth year of tax forms. This time of year is great because I can sit in front of the TV and shred while playoff football is on. It makes me feel like I can afford to spend the time watching while doing something useful at the same time.

Be prepared, it is amazing the volume of paper after shredding compared to before. It is not clear to me whether I can put it in the recycling bin or not. Sometimes I do but when they dump the bin, there is often a snowstorm of paper bits on the ground. I think the recyclers don’t like it because for that fact.

End Your Programming Routine: Part of why I dread this is it is a big job. It makes things much easier when everything has a place and it is in it. If you are not a consistent organizer, I highly recommend doing it this time of year because it really pays dividends for those other required things in life, like taxes.

Recent Comments